Indira IVF Hospital Ltd., backed by EQT, has confidentially submitted its draft documents for a potential market debut through the pre-filing route. This move places Indira IVF alongside other notable companies such as Swiggy Ltd., Credila Financial Services Ltd., and Vishal Mega Mart Ltd., which have also pursued confidential filings.

The company clarified that the filing of the pre-filed draft red herring prospectus does not guarantee that an Initial Public Offering (IPO) will take place. The filing is part of the confidential IPO process, which allows companies to keep certain details under wraps until they decide to move forward with the public offering.

In 2023, EQT, a Stockholm-based investment firm, acquired a controlling stake in Indira IVF from Boston’s TA Associates and the company’s founders. While TA Associates exited through the deal, the Murdiya family, the founders, retained a minority share and continue to lead the company.

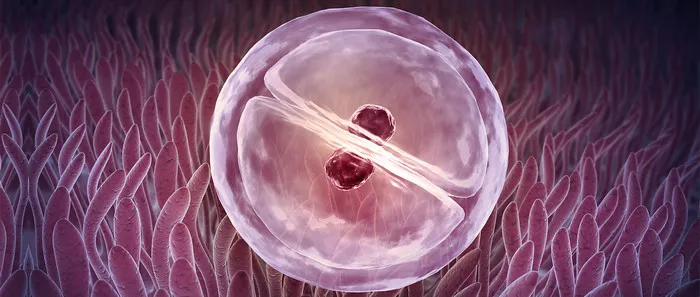

Reports from Bloomberg News in November 2024 revealed that EQT was aiming for a $400 million IPO for Indira IVF, with a projected valuation of around $2.5 billion. The fertility services provider operates over 150 centers across India, supported by more than 330 IVF specialists. Fertility rates in India are approximately 15%, a figure expected to rise, as noted by EQT in its statement upon acquiring its stake.

Confidential IPO filings were introduced by SEBI in December 2022, with Tata Play Ltd. becoming the first company to use this route. Under this mechanism, companies file their Draft Red Herring Prospectus (DRHP) confidentially, keeping the details private until they choose to proceed with their IPO. This process enables companies to safeguard sensitive information from competitors during the preparatory phase.

According to CICI Direct, the confidential filing process may take longer and incur higher advisory and legal costs compared to the traditional IPO route.

Related topics:

Study Identifies Molecular Drivers of Type 2 Diabetes in Women With Gestational Diabetes